Quebec Incorporation:

Quebec Incorporation has a unique Legal identity, and a thriving economic scene. Quebec an ideal Business Place for entrepreneurs. But where do you start?

RegiCorp streamlines the procedure, enabling you to begin your provincial Quebec incorporation in a matter of minutes. In this guide, we’ll unfold everything you need to know about the incorporation process in Quebec. So, why wait?

Table of Contents:

- The Essentials of Incorporating in Quebec

- Why Incorporate in Quebec?

- Corporation Types: Choosing the Right Business Structure

- The advantages of incorporating a business in Quebec

- Main differences between federal and provincial incorporation in Quebec

- Is federal incorporation more prestigious?

- Incorporation Checklist to Register a Business in Quebec

- Step-by-Step: Incorporating Your Business in Quebec

- Step 1: Decide on a Business Structure

- Step 2: Name Your Business

- Step 3: Create Your Articles of Incorporation

- Step 4: File the Articles of Incorporation

- Step 5: Establish a Registered Office and Board of Directors

- Step 6: Obtain Federal and Provincial Business Numbers

- Step 7: Register for the Quebec Sales Tax (QST)

- Step 8: Apply for Any Necessary Permits and Licenses

- Step 9: Set Up Corporate Records

- Step 10: Annual Declarations

- Step 1: Decide on a Business Structure

- The expense of forming a corporation in Quebec

- Costs for Federal Incorporation

- Costs for Provincial Incorporation in Quebec

- Continuous Costs After Incorporation

- Conclusion

- Frequently Asked Questions (FaQ)

Incorporating in Quebec

Incorporating in Quebec is like planting a seed that you hope will grow into a sturdy tree. It’s the legal process of turning your business idea into a recognized entity. We’ll walk through the benefits and how to navigate this journey.

Why Incorporate in Quebec?

Incorporation in Quebec is more than a legal formality; it’s a strategic move. Incorporating in Quebec is like planting a seed that you hope will grow into a sturdy tree. It’s the legal process of turning your business idea into a recognized entity. We’ll walk through the benefits and how to navigate this journey.

Easy to Register:

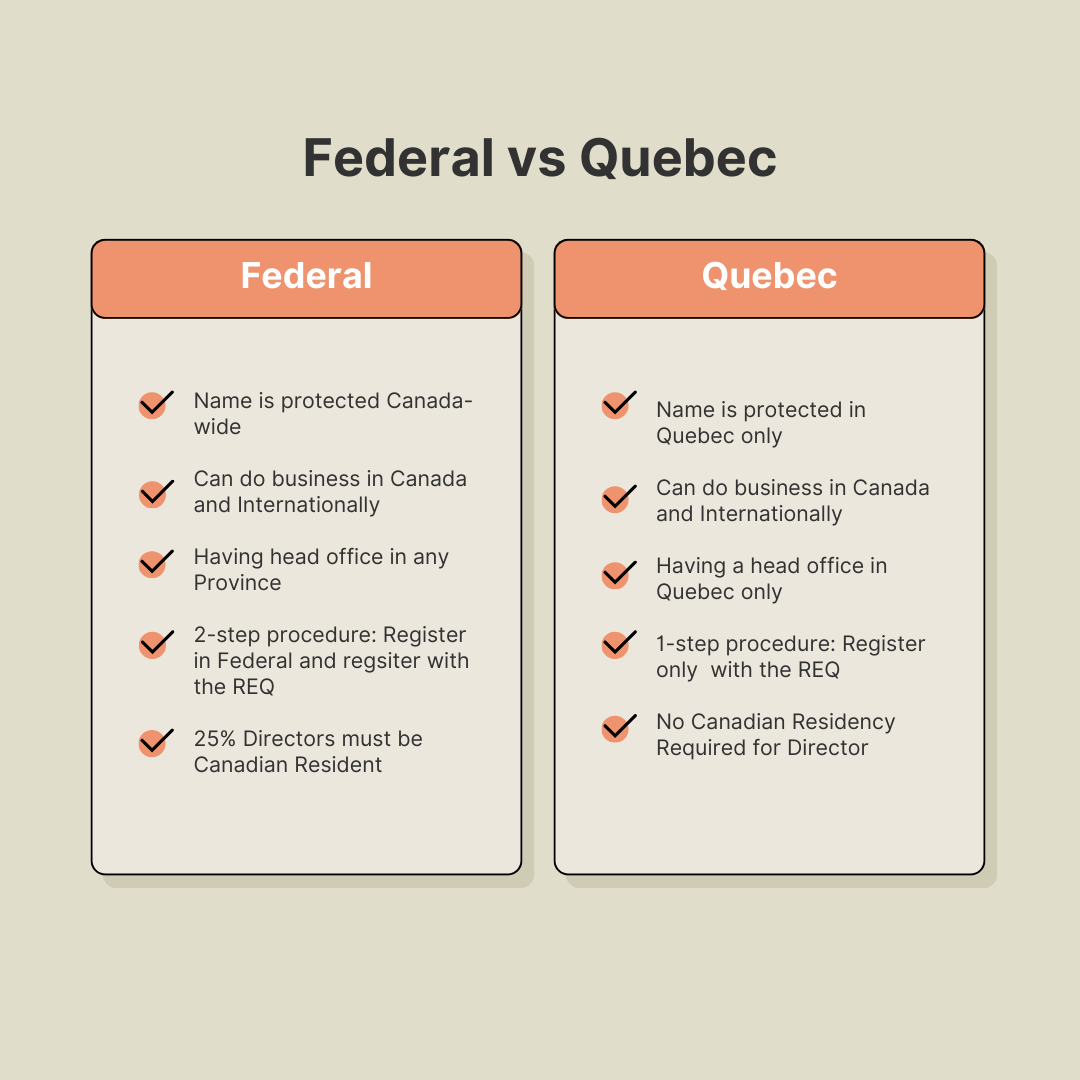

When you choose to incorporate a business at the federal level in Quebec, there’s a dual-phase procedure to follow. First, you must meet the federal incorporation criteria, and subsequently, you need to register with the Registraire des entreprises du Québec. This additional registration is not necessary if you opt for provincial incorporation, as it is a single-step process without the need for further registration

No Residency Requirements:

Businesses incorporated at the federal level are required to adhere to specific regulations regarding their board of directors. Notably, at least 25 percent of the directors must be Canadian residents, either as permanent residents or citizens. However, for businesses incorporated under the Quebec Business Corporations Act, there are no such stipulations concerning the residency or nationality of board directors.

Shares of a corporation can be bought and sold, which simplifies the process of transferring ownership. For a business owner looking to retire or move on to other Corporations, this can be a much smoother transition compared to unincorporated businesses.

Strong Provincial Support:

The Quebec government offers robust support for businesses, including grants, loans, and other financial aids designed to stimulate local economic growth and innovation. By incorporating in Quebec, businesses may have an easier time accessing these resources.

Bilingual Environment:

Operating in a province that officially embraces both French and English can be a significant advantage, particularly for businesses looking to serve a diverse clientele or expand internationally. Quebec’s commitment to cultural and linguistic duality can enhance a company’s local and global appeal.

Rich Cultural Sector:

Quebec is known for its dynamic cultural scene, which can be beneficial for businesses in creative industries. Incorporating in such an environment can provide networking opportunities, a vibrant talent pool, and a community appreciative of arts and innovation.

Strategic Location:

Quebec’s geographic location offers strategic advantages for trade, particularly with access to key markets in Canada, the United States, and Europe. For businesses involved in import-export, being incorporated in Quebec can provide logistical benefits and access to a broad market base.

Cost:

The cost of provincial registration with RegiCorp is considerably less expensive than others and the cost of a federal incorporation in Quebec.

Corporation Types: Choosing the Right Business Structure

Two types of corporations can be formed in the province of Quebec:

- Provincial Quebec corporation (a Quebec Inc.), or

- Federal corporation (a Canada Inc.)

A Federal corporation would be used if anyone wish to eventually set up office in other provinces in Canada. On the other hand If you wish to have an office in only Quebec then incorporation a Quebec corporation would be right for you. But it does not mean that registering in Quebec incorporation will limits your right to do business or export anywhere in the country or in the rest of the world.

The advantages of incorporating a business in Quebec

There are many advantages to incorporating a business in Quebec. Here are a few that will undoubtedly help you decide whether or not to incorporate your business:

- Protect personal assets: Personal Asset Protection for Director and shareholders

- Enjoy tax advantages: Less tax to be paid to Revenu Québec when filing your income tax returns.

- Easier capital acquisition: incorporation improves your chances to secure financing

- Legal existence Continuity: Incorporation means your business is an entity that persists through changes in management or ownership, a beacon of continuity.

- No obligation for Diretors: No obligation to have a board of directors at the federal level or any Residency in Canada.

- Income Accumulation: The possibility of accumulating income, keeping it, and using it later

Main differences between federal Incorporation and Quebec incorporation:

In Quebec, the decision to incorporate federally or provincially is pivotal, each offering distinct pathways and sets of benefits. Understanding the main differences between the two can guide entrepreneurs to make an informed choice that aligns with their business aspirations and operational strategies.

Legal Recognition Across Canada:

One of the primary differences lies in the scope of legal recognition. Federal incorporation provides a business with nationwide recognition, allowing it to operate in all provinces and territories under the same name without needing to re-register in each jurisdiction. In contrast, a provincially incorporated company in Quebec is recognized primarily within the province. If you plan to expand beyond Quebec, you’ll need to register in other provinces where you wish to do business.

Name Protection:

Name protection is another key area of differentiation. Federal incorporation typically offers enhanced protection of your business name across Canada. The federal government ensures that no other corporation can incorporate under the same name across the country. On the provincial level, while there is protection within Quebec, the name might be used by another entity in a different province, which could potentially lead to brand confusion.

Bilingual Requirements:

For federal incorporation, there is a requirement that your corporation’s name be in both English and French if the name has a descriptive component in either language. This bilingual requirement reflects the country’s commitment to linguistic duality. Provincial incorporation in Quebec, however, allows for the exclusive use of either French or English in the corporate name, but given the predominance of the French language in the province, there is a strong emphasis on having a French name.

Costs and Fees:

The cost of incorporation is also distinct between the two jurisdictions. Federal incorporation may come with higher initial fees and additional costs for registering in other provinces if you choose to do business outside Quebec. Provincial incorporation fees are generally lower, but the savings may be offset if you later decide to expand your business nationally.

Regulatory Compliance:

The regulatory environment between federal and provincial jurisdictions varies as well. Federally incorporated companies must comply with the Canada Business Corporations Act (CBCA), which mandates annual reporting requirements and other regulatory filings that are consistent across the country. Provincially incorporated businesses adhere to Quebec’s own set of corporate laws, which may differ in annual requirements, filings, and governance standards.

Tax implications are another aspect where federal and provincial incorporation diverge. Although tax rates may be similar, the nuances of federal and provincial tax credits, deductions, and incentives can impact your decision. Quebec offers specific provincial tax benefits that cater to locally incorporated businesses, which may not be available to federally incorporated entities.

Access to Government Contracts:

If you aim to secure government contracts, federal incorporation might provide an advantage, as some businesses report a preference for federally incorporated companies in federal procurement processes. However, Quebec’s provincial government also has contracts and opportunities tailored for provincially incorporated businesses, which could be advantageous at the local level.

Flexibility in Jurisdiction:

Federal incorporation offers greater flexibility in terms of where you can base your company’s headquarters within Canada. You’re not required to maintain a registered office in the province where you incorporated. For provincially incorporated businesses in Quebec, the primary office and address must be within the province.

Shareholder Residency:

There are also differences in terms of shareholder residency requirements. Federally incorporated businesses do not have strict residency requirements for directors; however, a certain percentage must be Canadian residents. For Quebec provincial corporations, there are no residency requirements for directors, offering more flexibility for international business owners.

Is federal incorporation more prestigious?

Lastly, some claim that a Corporation that has been federally incorporated has a certain status, even if there is no legal foundation for this.

Federal incorporation is seen as a mark of distinction, according to Corporations Canada’s pronouncements. In fact, federal firms are viewed as Canadian businesses everywhere, which can enhance the confidence that foreign investors and clients have in them.

Having stated that, Quebec Incorporations can conduct business with the rest of the globe without any legal restrictions.

Quebec Incorporation Checklist:

To register a Business in Quebec following need to be considered:

Step 1: Decide on a Business Structure

Step 2: Name Your Business

Step 3: Create Your Articles of Incorporation

Step 4: File the Articles of Incorporation

Step 5: Establish a Registered Office and Board of Directors

Step 6: Obtain Federal and Provincial Business Numbers

Step 7: Register for the Quebec Sales Tax (QST)

Step 8: Apply for Any Necessary Permits and Licenses

Step 9: Set Up Corporate Records

Step 10: Initial Return Filing

Step-by-Step: Incorporating Your Business in Quebec

Step 1: Decide on a Business Structure

Before you incorporate, decide on the type of corporation that best suits your needs. Quebec offers several business structures, including a named corporation, a numbered corporation, and a non-profit organization. Each has its own set of rules and implications for tax and liability.

Step 2: Name Your Business

If you opt for a named corporation, you’ll need to choose a unique name that complies with Quebec’s naming regulations. You’ll need to make to ensure your chosen name isn’t already in use or too similar to existing names.

Additionally, for a business operating in Quebec, the name must be in French, or have a French version of the name, and complies with the Charter of the French Language.

Your unique business corporation name must consist of:

- A distinctive element: a component that clearly distinguishes the corporation from any other

- A descriptive element: provides a general description of the services the corporation offers

- A legal Suffix: often in abbreviated form, this specifies the legal form of the enterprise

An example of a unique Quebec Incorporation name: ÉcoInnovations Lumière Inc.

If you do not select a unique business name for your corporation, you may have a numeric designation automatically assigned by the Registraire des entreprises du Québec.

The numeric Corporation will consist of:

- A unique number

- The word “Québec”

- Legal suffix “Inc.”

An example of number Corporation: is 6479-487191 Québec Inc.

Step 3: Create Your Articles of Incorporation

The Articles of Incorporation is a document that outlines the basic information about your company, including the corporate name, the address of the registered office, the board of directors, and the share structure. In Quebec, the articles must be drafted in French or be bilingual.

Step 4: File the Articles of Incorporation

You can file your Articles of Incorporation with the Registraire des entreprises (Quebec Business Registry). This can be done online, by mail, or in person. There is a fee associated with filing, which varies depending on the method of filing and other service options.

Step 5: Registered Office and Board of Directors

Your corporation must have a registered office in Quebec and a board of directors. The registered office is where official documents will be sent, and it doesn’t necessarily have to be your business’s operating address. The board of directors will be responsible for overseeing the corporation’s activities.

Step 6: Obtain Federal and Provincial Business Numbers

Once your corporation is registered, you’ll receive a provincial business number. You must also apply for a federal business number and tax accounts for the Goods and Services Tax/Harmonized Sales Tax (GST/HST), payroll deductions (if you have employees), and corporate income tax.

Step 7: Register Quebec Sales Tax (QST)

If you expect your corporation’s taxable sales to exceed $30,000 annually, you must register for the QST. This is similar to the GST/HST but is specific to Quebec.

Step 8: Apply for Any Necessary Permits and Licenses

Depending on the nature of your business, you may need specific permits or licenses to operate legally in Quebec. Check with both the municipal and provincial governments to determine what you need.

Step 9: Set Up Corporate Records

Every corporation in Quebec is required to keep corporate records, such as minutes of meetings, resolutions, share registers, and financial statements. These must be kept at the registered office or another location in Quebec as determined by the board of directors.

Step 10: Initial Return Filing:

Finally, Quebec corporations must file an Initial Return declaration with the Registraire des entreprises. This maintains the corporation’s status as an active entity and updates the government on any changes to the corporation’s address, directors, or activities.

This is mandatory to file initial Return within 60 days of a Quebec Corporation’s incorporated. This contains information about your business including Director, office, shareholder and head office. Faiure to file iitial Return may cause dissolve a corporation by Registraire des entreprises.

Incorporating in Quebec is a significant step that provides a strong foundation for your business operations. It’s advisable to consult with a legal professional or an accountant to navigate the intricacies of the incorporation process, especially if your business structure has complex share configurations or you’re unfamiliar with Quebec’s legal requirements.

The Cost of forming Quebec Incorporation

With RegiCorp, you can breeze through incorporating your business in Quebec. It’s designed for small business owners to register and set up their corporation in under 15 minutes. RegiCorp’s Quebec provincial incorporation package starts at $699, covering all the services we’ve mentioned, like a full year of the Online Minute Book plan, registering your company name, creating organizational documents & share certificates, plus access to RegiCorp Perks. For ongoing assistance, check out their various pricing and package options.

Cost for Federal Incorporation:

Filing your incorporation papers federally costs $200 CAD, or $300 CAD if you choose the expedited service.

A NUANS name search report, which verifies that your business name meets certain standards, is an additional $49 CAD. Note that this isn’t necessary for alternate names, such as a French name if the primary name is in English.

If you incorporate federally, you must also register with Quebec’s business registry, the Registraire des entreprises du Québec, which has its own fee structure.

Expect to pay more for various compliance-related filings.

Cost for Quebec Incorporation

The starting fee for registering your business in Quebec is $350 CAD, or $534 CAD for expedited service.

While a NUANS search isn’t mandatory, you might incur costs for a different name search service to meet legal requirements.

Additional legal costs may arise when filing with the government.

Continuous Costs After Incorporation:

Once your business is up and running, you’ll have ongoing fees and paperwork to maintain its legal status:

GST/QST numbers:

These are tax numbers from Revenu Quebec that you must obtain post-incorporation.

Annual Return:

Quebec requires businesses to affirm their information is current each year within a set time frame. Any updates needed must be made through an annual declaration.

Annual Return fee:

This is due yearly on every annivarsary month of incorporation month.

Minute book:

Keep records of your company’s critical details in a minute book, which can be a physical or digital document. It’s vital to ensure this step is completed, as it is not automatically provided.

Remember, these are the baseline costs, and your actual expenses may vary depending on additional services and legal advice you might need.

Conclusion: Embarking on Your Quebec Business Journey

As we wrap up, remember, that your business journey in Quebec is unique. With the right knowledge and tools, you’re well-equipped to navigate this exciting venture.

Frequently Asked Questions

- What are the first steps to take when starting a business in Quebec?

The first steps include deciding on a business structure, choosing a business name, and registering your business with the appropriate Quebec authorities.

- Is obtaining a business license mandatory in all businesses in Quebec?

Yes, most businesses will require some form of a license or permit to operate legally in Quebec.

- How important is it to understand local regulations when opening a business in Montreal?

It’s crucial. Understanding local regulations ensures your business operates within the legal framework and avoids potential penalties.

- What financing options are available for small businesses in Quebec?

Financing options range from bank loans and government grants to private investments and crowdfunding.

- Can I register my business in Quebec if I’m not a Canadian citizen?

Yes, non-Canadians can register a business in Quebec, but there may be additional requirements or limitations based on your status.

- Is incorporating in Quebec beneficial for small businesses?

Absolutely, incorporating can provide credibility, tax advantages, and legal protection, vital for small businesses in Quebec’s competitive landscape.

- How long does it typically take to register a business in Quebec?

The timeframe can vary, but typically, the registration process can be completed within a few weeks, assuming all paperwork is in order.

- What are some common mistakes to avoid when starting a Quebec Incorporration?

Common mistakes include neglecting market research, underestimating financial needs, and overlooking legal and regulatory requirements.

- How important is it to have a digital presence for a new business in Quebec?

In today’s digital era, having a strong online presence is crucial for reaching a wider audience and establishing your brand in the Quebec market.